Contents:

You may have to cut back on future dividends to avoid it happening again. Some businesses have run into trouble using borrowed money to pay dividends even when the company’s unprofitable. It may also elect to use retained earnings to pay off debt, rather than to pay dividends. Another possibility is that retained earnings may be held in reserve in expectation of future losses, such as from the sale of a subsidiary or the expected outcome of a lawsuit. Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. Retained earnings are calculated through taking the beginning-period retained earnings, adding to the net income , and subtracting dividend payouts.

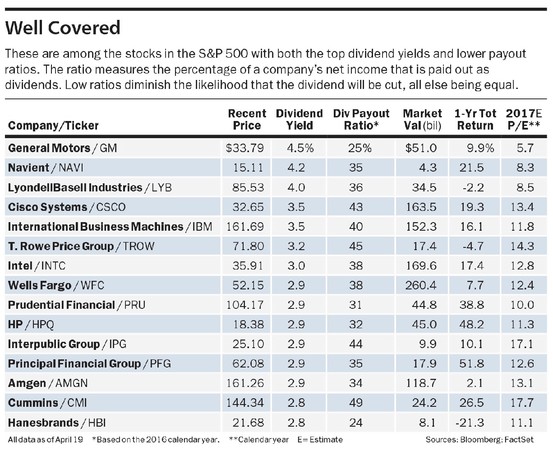

Even with positive profits each year, the buyback effects could be larger than the positive effects of net income that might increase retained earnings as year-end closing entries. Excessive dividend payments could also cause retained earnings into negative. Many negative earnings and long-run operating losses indicate that the entity might face going concerned or bankrupt. The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company’s net income. On one hand, high retained earnings could indicate financial strength since it demonstrates a track record of profitability in previous years. On the other hand, it could be indicative of a company that should consider paying more dividends to its shareholders.

Negative retained earnings?

Please consult legal and financial processionals for further information. The earnings can be used to repay any outstanding loan that the business may owe. It can be invested to expand existing business operations, like increasing the production capacity of the existing products or hiring more sales representatives. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

The income would raise the retained earnings balance to $40,000, and the payment of shareholders’ dividends would reduce it by $20,000, leaving $20,000 in the retained earnings account. Retained earnings refer to the total net income of a business after it has paid dividends to its shareholders. If a business is flourishing, shareholders may be paid dividends as a reward for their financial support. After these payments have been made, earnings can be reinvested back into the company. The size of the dividend paid to its shareholders will be determined by the business and may depend on the company’s aims for the future.

Retaining earnings by a what is negative retained earnings increases the company’s shareholder equity, which increases the value of each shareholder’s shareholding. This increases the share price, which may result in a capital gains tax liability when the shares are disposed. Anyone looking to invest in your company or loan your company money will want to know why you have an accumulated deficit. If you’re a struggling startup, it might be understandable that you ran into trouble.

Tesla (TSLA) Accumulated Deficit Example

If the company had not retained this money and instead taken an interest-bearing loan, the value generated would have been less due to the outgoing interest payment. RE offers internally generated capital to finance projects, allowing for efficient value creation by profitable companies. However, readers should note that the above calculation is indicative of the value created with respect to the use of retained earnings only, and it does not indicate the overall value created by the company.

Transcript : Great Ajax Corp., Q4 2022 Earnings Call, Mar 02, 2023 – Marketscreener.com

Transcript : Great Ajax Corp., Q4 2022 Earnings Call, Mar 02, 2023.

Posted: Thu, 02 Mar 2023 22:00:00 GMT [source]

When total assets are greater than total liabilities, stockholders have a positive equity . Conversely, when total liabilities are greater than total assets, stockholders have a negative stockholders’ equity — also sometimes called stockholders’ deficit. It means that the value of the assets of the company must rise above its liabilities before the stockholders hold positive equity value in the company. Retained earnings are reported in the shareholders’ equity section of the corporation’s balance sheet. Corporations with net accumulated losses may refer to negative shareholders’ equity as positive shareholders’ deficit.

Retained EarningsRetained Earnings

These are the main factors that can lead retained earning into a negative, and there are many other factors like sales, cost of goods sold, and operating expenses are also factors that need to consider. This negative figure on your financial records guarantees that your shareholders will receive a smaller slice of the pie, as there is simply less pie to share. Older companies have time on their side – the longer your company has been around, the more time to compile retained earnings. The statement of retained earnings is defined as a financial statement that outlines the changes in retained earnings for a specified period. The decision to retain the earnings or distribute them among shareholders is usually left to company management. As the company matures, it is reasonable to expect them to climb out of the negative retained earnings status and become a grown-up company.

Yes, prima facie, it is possible for a company to pay dividend out of reserves. … The total amount to be drawn from such accumulated profits shall not exceed one-tenth of the sum of its paid up share capital and free reserves as appearing in the latest audited financial statement. When the dividends are paid, the effect on the balance sheet is a decrease in the company’s retained earnings and its cash balance. In other words, retained earnings and cash are reduced by the total value of the dividend. You’ll find retained earnings listed as a line item on a company’s balance sheet under the shareholders’ equity section.

Look at Starbucks’ balance sheet to understand how negative retained earnings could affect the company. If the retained earnings are negative, it could drive the shareholders’ equity negative, leading to bankruptcy. Other exceptions where negative retained earnings are not necessarily a negative sign include the payout of dividends, which contributes to lower retained earnings. An accumulated deficit occurs when a company has incurred more losses than profits since its inception.

- An easy way to understand retained earnings is that it’s the same concept as owner’s equity except it applies to a corporation rather than asole proprietorship or other business types.

- The income money can be distributed among the business owners in the form of dividends.

- When evaluating the amount of retained earnings that a company has on its balance sheet, consider the points noted below.

- Although dividend yields cannot be negative, your total returns may fall into the red when share prices decline significantly.

- Having illegal dividends in the company accounts can also make the company look insolvent having negative balances on the balance sheet.

- Conversely, a sustained period in which sales are poor is likely to see an increase in the chances of negative retained earnings.

Although student loans allow people to acquire an education, which, in turn, makes them more financially stable, it cannot be counted as a physical asset. Therefore, while the student loan is being repaid, the person who owns the loan has a negative net worth. It happens when the value of the asset remains constant, but the amount of the loan balance goes up. It can be due to the borrower not making sufficient repayments to the lender. The issue of bonus shares, even if funded out of retained earnings, will in most jurisdictions not be treated as a dividend distribution and not taxed in the hands of the shareholder. Although dividend yields cannot be negative, your total returns may fall into the red when share prices decline significantly.

In rare cases, it can also indicate that a business was able to borrow funds and then distribute these funds to stockholders as dividends; however, this action is usually prohibited by a lender’s loan covenants. Now let’s say that at the end of the first year, the business shows a profit of $500. This increases the owner’s equity and the cash available to the business by that amount. The profit is calculated on the business’s income statement, which lists revenue or income and expenses. Owner’s equity refers to the assets minus the liabilities of the company. Owner’s equity belongs entirely to the business owner in a simple business like a sole proprietorship because this form of business has just a single owner.

A report of the movements in retained earnings are presented along with other comprehensive income and changes in share capital in the statement of changes in equity. At the end of that period, the net income at that point is transferred from the Profit and Loss Account to the retained earnings account. If the balance of the retained earnings account is negative it may be called accumulated losses, retained losses or accumulated deficit, or similar terminology. When you give dividends, you have less to contribute to retained earnings. It’s possible the accumulated deficit results from too big a dividend and not retaining enough earnings.

What Is the Difference Between Retained Earnings and Revenue?

If Stock Y pays out a 1 percent dividend yield, your total return would be negative when Stock Y’s share price falls by more than 1 percent. When investing in negative earnings companies, a portfolio approach is highly recommended, since the success of even one company in the portfolio can be enough to offset the failure of a few other holdings. The admonition not to put all your eggs in one basket is especially appropriate for speculative investments. It takes a leap of faith to put your savings in an early-stage company that may not report profits for years. The odds that a start-up will prove to be the next Google or Meta are much lower than the odds that it may be a mediocre performer at best and a complete bust at worst.

https://1investing.in/ retained earnings can be influenced by a myriad of factors and may be understood and budgeted for by a business, particularly if that business is new. It may be a temporary state of affairs for a company that is investing to cover a period of expansion, requiring costs to increase in the short term. However, in the long term, businesses will, by and large, look to avoid seeing their earnings balance tip into the negative. Remember, retained earnings can be influenced by a range of factors, including costs, fluctuations in the market, developing trends, and competitor pressure.

These profits are reinvested in the business towards working capital requirements and for purchasing of fixed assets. In some countries, if the equity turns to a level below the requirement, shareholders or owners are normally required to inject more funds. Portion of a business’s profits that are not distributed as dividends to shareholders but instead are reserved for reinvestment back into the business. Normally, these funds are used for working capital and fixed asset purchases or allotted for paying off debt obligations. Retained earnings are the portion of a company’s cumulative profit that is held or retained and saved for future use.

Careful analysis will need to be undertaken by the business to determine how it has arrived at a state where retained earnings are now negative. Profits give a lot of room to the business owner or the company management to use the surplus money earned. This profit is often paid out to shareholders, but it can also be reinvested back into the company for growth purposes. If a corporation has purchased its own shares of stock the cost is recorded as a debit in the account Treasury Stock. The debit balance will be reported as a negative amount in the stockholders’ equity section, since this section normally has credit balances.

If you have a $5,000 negative retained earnings entry, you subtract that from the total equity. If the stock appears overvalued and there is a high degree of uncertainty about its business prospects, it may be a highly risky investment. The risk of investing in an unprofitable company should also be more than offset by the potential return, which means a chance to triple or quadruple your initial investment.