Contents:

A service provider records https://1investing.in/ as soon as a sale is complete. However, in the construction industry, this isn’t always possible. That’s where the percentage of completion for contractors comes in.

You can also get reports on tasks, timesheets, workload and more. All reports can be filtered and easily shared to keep your stakeholders updated. We have features that provide a high-level view and others to get deeper into the data. Our real-time dashboard monitors six project metrics, including progress, which shows the percent complete for each project task. That’s why the Gantt chart is only one of our multiple project views in which you can track the percent complete of your team’s tasks. If you’re working on the sheet view, you’ll see the percent complete on the corresponding column, which is updated by the team member assigned to that task as they move through their assignment.

As you probably remember from high school math class, a percentage is a fraction of 100 that is calculated by dividing the numerator by the denominator and multiplying the result by 100. Use the income statement equation approach to compute the number of shows British Productions must perform each year to breakeven. From the output we can see that 0.3 or 30% of the tasks have been completed. The Percentage of Completion value for the COGS can only be modified/ calculated for the existing revenue data. For extensions, the percentage completed value must be specified manually because EAC is not defined for extensions.

Contract Line Percent Complete Cost

The contract is worth $200 million and the company is expected to complete it in 3 years. In Year 1 the company has incurred an amount of $50 million on the contract and the engineers estimate that in the next 2 years the company is expected to expend $110 million more. Based on the physical progress of the project the engineers also estimate that 40% of the work has been carried out. Let’s say in year 2, due to some unforeseen circumstances, the project’s total cost is recalculated to $12 million.

Bill-and-hold basis recognizes revenue at the point of sale, with goods delivered at a later date. This method can only be used if payment is assured and estimating completion is relatively straightforward. Go a level deeper with us and investigate the potential impacts of climate change on investments like your retirement account. Note that in the first year, the previously recognized revenue is zero.

How to Calculate the Percentage of Work Completed?

They are categorized as what is a deposit slip assets on the balance sheet as the payments expected within a year. Both parties to the contract should be able to fulfill the contractual obligations. The contractee should be able to pay and take complete responsibility for the project once the work is completed and the risk is transferred to them.

This approach is better than the completed contract method, since there is at least some indication of economic activity that spills over into the income statement prior to project completion. The percentage of completion method is an accounting method in which the revenues and expenses of long-term contracts are recognized as a percentage of the work completed during the period. This is in contrast to the completed contract method, which defers the reporting of income and expenses until a project is completed. The percentage-of-completion method of accounting is common for the construction industry, but companies in other sectors also use the method. Distilling a partially completed project into accurate, reportable figures can feel like a mathematical feat when so many variables are involved.

Methods for Calculating the Percentage of Completion

What if i need to multiply gross salary of my employees based on their gender. So let’s say I have column A as total boxes, column b is the variance (what I’m trying to figure out) and column c is the goal 10%. I am trying to come up with I believe a variance to a goal, which is a percent.

Puzzle game-based learning: a new approach to promote learning … – BMC Medical Education

Puzzle game-based learning: a new approach to promote learning ….

Posted: Thu, 13 Apr 2023 14:51:49 GMT [source]

When builders execute change orders before accountants include them in the project’s costs, it appears like they’re overbilling the project. Even if the numbers match up in the future, the current accounting period will reflect inaccurate losses. In this method, you compare the calculated percentage of effort expended to date to the total estimated effort to be expended for the duration of the contract. Some of the indices used to measure the percentage of cost with this method are the number of materials, machine hours, and man-hours.

What Is Percent Complete?

The percentage of completion method is one of the most common methods of accounting used in construction. In this article, we’ll explain the percentage of completion method, how it works, and give you some real-life examples. Given a sales price, total costs, and costs per period, this determines the gross profit to date using the percentage of completion method.

I have done it before on the old version of excel but can’t figure it out on the new. I want to make a column to the right that gives 75% of the column on the left, but cannot figure out the formula. So Column B has a bunch of numbers, and column C I want to figure out what 75% of each cell is and mark it to the right.

Example 1. The total is at the end of the table in a certain cell

The calculation of the percentage of this number is described in detail in this article above. Hi, in Cell F14 I have the result of a formula to calculate daily rates at 10% occupation for a 7 day period plus a once-off fee. In cell F16 i want reduce the result in F15 by a further 10% . I need to find what the percentages is between a commission figure and what the payee gets paid. I am having to put the selling price in first, in order to calculate the margin percentage.

- This gives you the percentage of the work that has been completed during the period.

- So Column B has a bunch of numbers, and column C I want to figure out what 75% of each cell is and mark it to the right.

- I assume that for your task will be useful Classic nested IF formula.

- Note that the COUNTA function counts the number of cells in a range that are not empty.

Percentage of completion is a method of accounting for long-term projects in which revenue and expenses are recognized based on the percentage of work they have completed during the period. Under percentage of completion, a contractor recognizes project income and expenses as the project progresses, usually on a monthly basis. So, in short, whenever there are long-term contracts, the estimated revenue and costs are split across the length or the duration of the project. Now, as time goes by and the project makes progress towards completion, the revenue and costs for the period are recorded into the accounting books on a pro-rata basis.

NFL, NFLPA Approve Helmet Designed To Reduce QB Concussions – ESPN Sioux Falls

NFL, NFLPA Approve Helmet Designed To Reduce QB Concussions.

Posted: Thu, 13 Apr 2023 17:22:44 GMT [source]

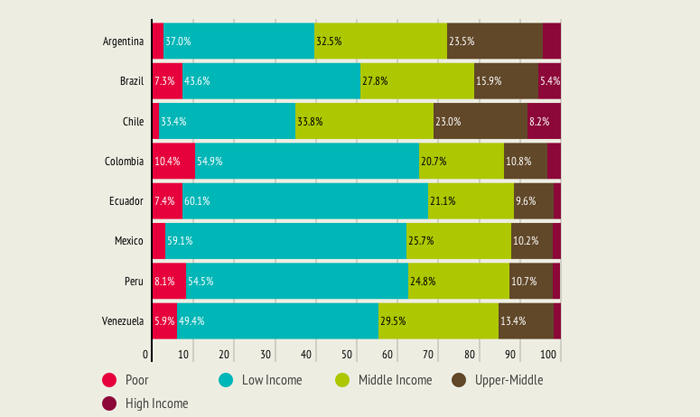

Where outcome in respect of a contract is not certain, stage of completion method is not used to account for the construction contract. In the chart below, compute each company’s gross profit in terms of dollars and as a percentage. Calculates percent complete at the contract line level, if the calculation level in the revenue plan is contract line. Taking our example from above, a 10-day task duration will look like a bar going from the start date to 10 days into the project.

- The next step is figuring out how to calculate for percent complete.

- Using percent complete income recognition requires some specific data that can be difficult to gather if you aren’t using construction accounting software.

- Can I know what is the formula to get the calculations between the ordered date and date received with the number of orders.

- This would mean that only 25% of the contract was completed in the second year, and revenues relating to that 25% of work should be recognized for the current period.

But the IRS requires businesses to recognize revenue in the period in which they earned it. Contractors and subs who aren’t waiting for years to get paid can’t wait for years to report income. The only exception is small contracts that companies will complete within two years. To meet this exception, contractors must be considered a small business that has grossed $25 million or less over the past three years, and the project must be completed within two years. Contractors who can’t meet these criteria must report income during the project.

Use the Percentage Completion method with construction based projects that extend over the course of several years. Furthermore, many accountants prefer the percentage completion accounting over the Completed Contract Method. Because the projects are usually long term lasting several years, it estimates completion for the company. So it shows revenues year by year than to just all of the sudden have one large inflow at the end where the project was completed. Generally accepted accounting principles require that revenue be recognized in the period it was earned. Stored materials don’t represent completed work, so they have to be treated differently.