Contents:

Well think of all the books you needed to consume for school, well at a minimum you need to read at least that many when it comes to trading. It is up-to-date with the most recent theories, methods, and strategies to increase the work’s relevance in today’s marketplaces. The author has given special attention to vertical bar charts and how chartists might use them to their advantage in regular trading. This book can be helpful to traders regardless of the method they employ. This method demonstrates the general applicability of its concepts by successfully being used to analyze futures markets, equities, speculation, and hedging. This book demonstrates how to use this technique with any other analytical instrument to confidently evaluate practically any market, including futures, for hedging and speculating.

Technical analysis is a crucial skill for any stock trader to thoroughly understand and be able to implement to make the wisest decisions when trading, buying and selling on the stock market. Browse the list and find the best books for you as you continue to make your trading decisions to ensure you are always making the best moves. Considered to be a critical read and resource for investors everywhere,Technical Analysis of Stock Trends, 8th Editionis a book that tackles the modern challenges of trading. The book clearly explains such basics as chart patterns, trading ranges, trends, stops, entry, and exit approaches.

Technical Analysis Masterclass by Rolf Schlotmann

While writing this book, the author researched over 100 years of stock price history and movement and has presented the top technical strategies that can maximize profits and minimize losses. Furthermore, O’Neil’s extensive research has enabled him to guide investors, in his book, the tips for minimizing risk and finding the entry and exit points. Japanese candlestick charting technique is older than bar charts and points and figure charts. The focus of this book is the US markets but the methods and techniques can be used for every market.

- While writing this book, the author researched over 100 years of stock price history and movement and has presented the top technical strategies that can maximize profits and minimize losses.

- It offers helpful information on technical indicators, chart patterns, and candlestick charting, supported with practical examples and a focus on practical application.

- The book also covers the history of charting analysis and Japanese Candlestick Charting Techniques.

- This book is an essential addition to the other books as it focuses on psychology and sentiment, which are critical for you to understand.

- As we know that markets have changed recently and so have technical indicators.

Understand how to reach Japanese candlestick charts and recognise 7 bullish and bearish patterns. These include the Hammer / Hanging Man , Inverted Hammer / Shooting Star and Engulfing patterns. You’ll find a candlestick cheat sheet on the very last page summarising all patterns in one place. CONGRATULATIONS ON your personal copy of Advanced Technical Analysis for Forex. We continue our journey from the first book to acquire a broader and deeper understanding of technical analysis for forex. What’s most interesting is how the charts of economic bubbles that occured more than 400 years ago look eerily similar to recent market bubbles like bitcoin in 2017 or the dot-com bubble of 2000.

“Technical Analysis Explained” by Martin J. Pring was originally published in 1980 and offers a step-by-step guide to incorporating technical analysis into your trading routine. Elliott Wave Principle is one of the most popular trading strategies used by traders. This book provides complete analytics on the Elliott Wave Principle and how to study the larger movements of the stock market. Through this book, the learning of the Elliott wave can help traders comprehend and understand the seemingly random movements of the market and can predict future market movements with more accuracy.

Many people who invest for the long term look at current trends to indicate whether it’s a good time to buy or sell an asset. For example, if a company has a strong quarterly financial report, its shares are likely to increase in value. Our experts choose the best products and services to help make smart decisions with your money (here’s how). In some cases, we receive a commission from our partners; however, our opinions are our own.

Book #5: Japanese Candlestick Charting Techniques

Novice traders may want to check out this book before diving into more complex topics. Encyclopedia of Chart Patterns by Thomas N. Bulkowski comprehensively covers chart patterns that provide distinct opportunities in the market. The author tells readers how to trade key events, such as retail sales, quarterly earnings reports, stock downgrades and upgrades.

This book provides an in-depth explanation of candlestick plotting and analysis through hundreds of examples. Understand how candlestick techniques can provide early reversal signals, and improve your timing entering and exiting markets. Cory Mitchell, CMT, is a day trading expert with over 10 years of experience writing on investing, trading, and day trading. Mitchell founded Vantage Point Trading, which is a website that covers and reports all topics relating to the financial markets.

#3 – Technical Analysis from A to Z

This book gives the reader a realistic point of view of the market and how it behaves. In fact, it provides a complete solution to all queries of a trader who has just begun his trading journey. The hallmarks of this book are an analysis of chart patterns and an examination of the development of the Dow theory. This 1948 publication, which focuses on vertical bar charts and emphasizes their value for market analysis, continues to be a key tool for chartists. The most recent edition of the work also has a ton of newly updated information on the subject.

Stock market technical analyst Ashwani Gujral passes away Mint – Mint

Stock market technical analyst Ashwani Gujral passes away Mint.

Posted: Mon, 27 Feb 2023 08:00:00 GMT [source]

Throughout the book, Grafton provides numerous real-world examples to help illustrate the concepts being discussed. The book covers everything from how to set up a chart to identifying trendlines and formations. Uniquely and importantly, the book focuses on the flow of funds, system trading, money management, sentiment, and a brief look at statistics. The authors provide real-world examples to help illustrate how technical analysis can be used in practice. He also includes several helpful appendices, including one that lists all the indicators and oscillators used in the book.

It is the first best technical analysis books to develop a strategy for analyzing the predictable behavior of investors and markets was Technical Analysis of Stock Trends. Furthermore, it emphasizes fundamentals like earnings, sales growth, management, and goods. It may be the best read for broad principles rather than strict regulations since it is a difficult section of the book.

This is not a beginner’s guide, but I am going to cover all the basics you need to get started with my strategy, even if you have never made any trade at all. We will keep you posted with cutting edge articles, tips, tools and analysis to power you forward on your trading journey. Encyclopedia of Candlestick Charts – this focuses specifically on candlestick charts, covering more than 100 patterns, as well as providing interesting information about how the field has evolved. Trading Classic Chart Patterns – this is a perfect complement to Bulkowski’s encyclopedia, delivering lots of practical advice for both novice traders and experienced ones. To thrive in this market, you must also commit yourself to follow a strict money management plan.

Moreover, the book also demonstrates the best ways to trade crucial events like retail sales, stock upgrades, stock downgrades, etc. Such information is imperative as such events are instrumental in shaping modern trading. The plus point is the statistical backing Bulkowski has provided to his approach.

“Extraordinary Popular Delusions and the Madness of Crowds” by Charles MacKay was first published in 1841. But despite being nearly 180 years old, much of the content still rings true today. The book is separated into three volumes, and investors interested in technical analysis should focus on the first volume, which is focuses on historical economic bubbles. Stock charts can be a helpful resource for traders who are trying to navigate a volatile market, especially in 2020, which has seen big swings due to the coronavirus pandemic. Many online retailers offer discounts on certain books for technical analysis, so it’s worth checking around to see if you can snag a good deal.

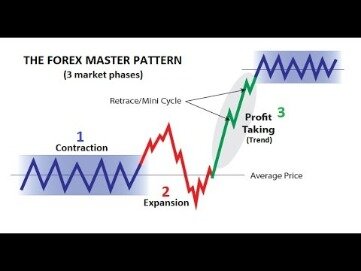

O’Neil describes in detail key issues like choosing the best industry groups, chart reading to make better decisions, and how to reduce losses and maximize profits. An excellent reference book for traders willing to learn about using technical analysis in futures markets with success. These patterns show you how a stock has performed repeatedly in the past — and according to technical analysis, the asset will likely perform this way again. Murphy’s book starts with basic information, such as the concept of a trend and chart. Then he moves onto topics such as major reversal patterns, continuation patterns, and long-term charts. If these terms are unfamiliar to you, this could be a good book to take your understanding to the next level.

The first part covers the limelight of the book and that is the explanation of trend determining techniques. Martin explains trendlines, price patterns, business cycles, levels of support and resistance, and momentum indicators including his own “Know Sure Thing” indicator. There are multiple types of candlestick patterns that can help you try to predict how an asset will perform in the future. This book goes through the history and significance of candlestick charts, then explains each of the pattern types. Bulkowski starts by explaining how to trade by looking at chart patterns, then dives into over 70 patterns you can use to determine when to buy and sell an asset based on technical analysis.

It also https://trading-market.org/ case studies of how the technique is used for trading various securities. Overall, the book provides a comprehensive guide to using the Ichimoku Technique for trading success. The book provides a detailed description of how cloud chart works and how they can be used together to make trading decisions. We research technical analysis patterns so you know exactly what works well for your favorite markets.

In this presentation, originally titled “A Technician’s Approach to Day Trading”, Martin Pring explains how to identify trends and spot trend reversals ahead of time. Trade Your Way to Financial Freedom offers a look at the common mistakes that forex traders regularly make and how to avoid and overcome them in a realistic way. The author promotes an open-minded approach, that the books reviews rave about. His trading style works in today’s markets and will forever do so going forward. This book dives straight in and explains his systems that he has modified for the current markets. Bill Williams is known for creating several trading indicators to predict market movements with high probability.